Reversing 30 years of gradual decline

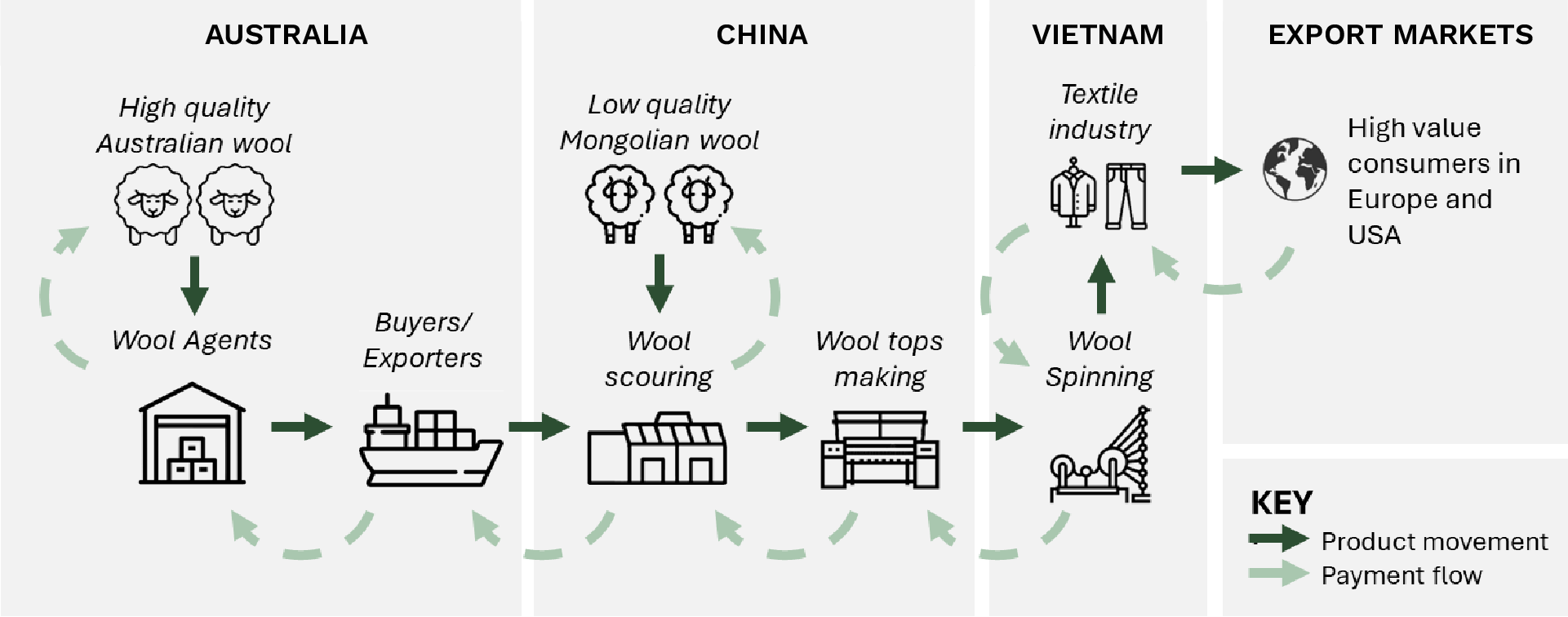

As the Australian wool industry lost its domestic manufacturing capacity and became reliant on Chinese processors, the industry lost its confidence in its future.

Over the past 30 years, China has gained control of the Australian wool clip and with its dominant market position, gained control over prices for raw/greasy wool, destroyed local wool processing and the industry’s confidence in its future.

The Australian wool industry is now less than half of what it was 30 years ago.

Reimaging the wool supply chain

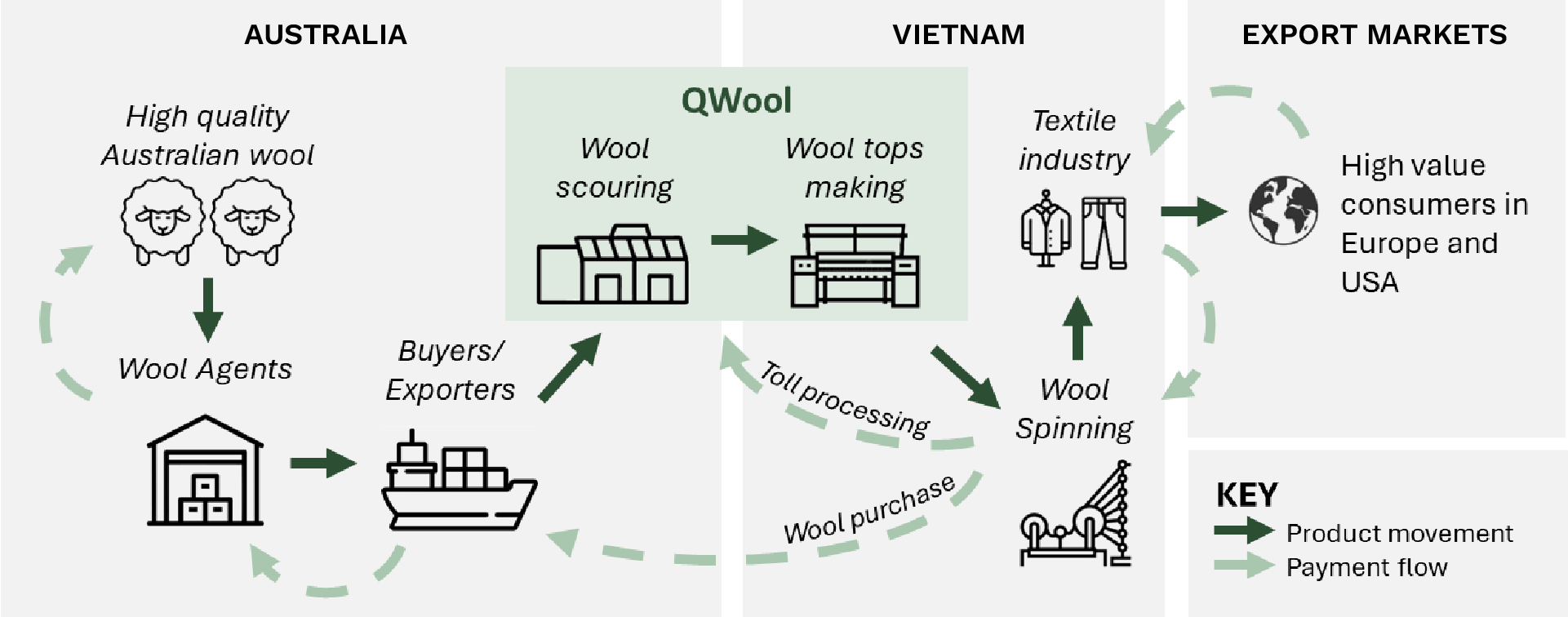

By reaching further into the wool supply chain, the Australian wool industry can diversity its markets, reduce logistics costs, capture additional value that allows a return domestic processing to Australia at the same time.

Notes:

- Wool scouring involves washing the raw “greasy” wool to remove wool grease (lanolin), dirt and other impurities, to produce clean wool.

- Tops making involves combing of clean wool to remove short fibres and produce a continuous, rope-like strand of strong wool fibres, ready for spinning.

Spinning involves twisting of fibres in wool tops into smaller, stronger fibres that are ready for weaving into fabrics.

Wide-ranging benefits throughout the supply chain

Australian wool producers

Gain higher returns through new markets, deeper value chain access, and a stronger supply chain.

Global textile industry

Regional communities

All levels of government

Remaining A-NZ wool processors

QWool Industry Transformation Strategy

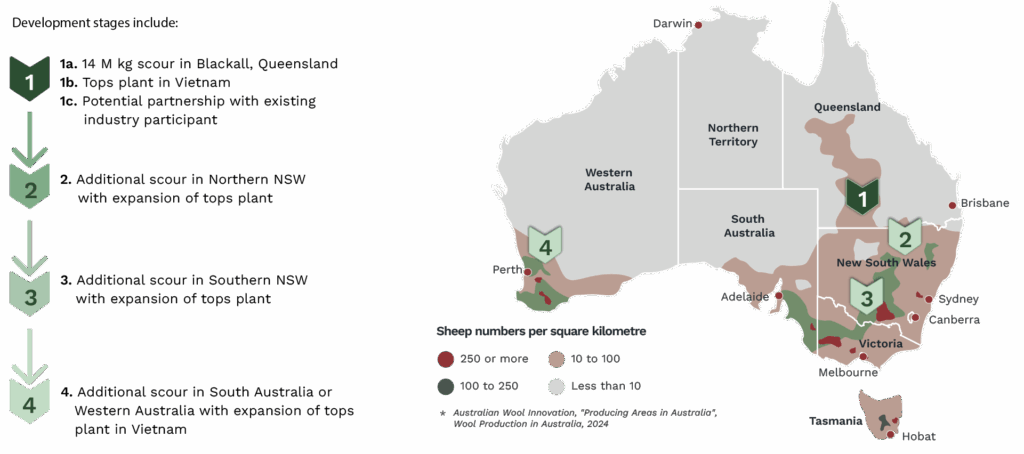

The QWool vision is for a multi-stage development for the wool industry, which can value-add up to 30% of the Australian wool clip. The remaining 70% of the wool clip will benefit from increased buyer competition for high quality Australian wool.

Pursuing New Market Opportunities

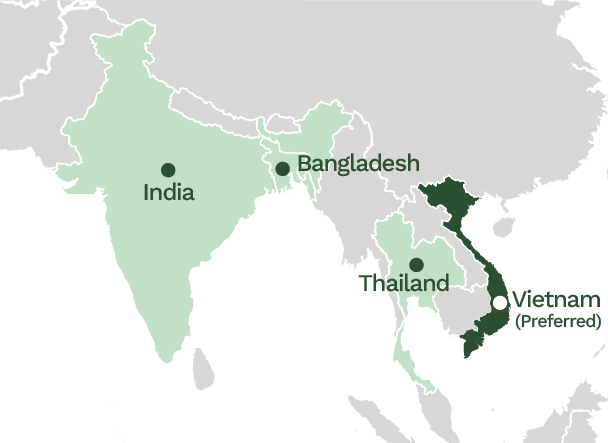

Research commissioned by Wool Producers Australia has identified a number of alterative export markets for Australian wool, including Vietnam, Thailand, Bangladesh and India. Vietnam was selected as the preferred market.

Vietnam has approximately 20 million Kg of installed spinning capacity and import 98% of all wool tops from China, produced from a blend of superfine Australian merino wool and lower-quality Mongolian wool.

QWool’s project plan includes building a new tops plant in Vietnam to turn the clean wool into a ready-to-spin product for the textile industry, creating a direct connection to key Asian garment manufacturers.

All supply chain participants will benefit from a substantial reduction in logistics cost, utilising low back freight rate Australia to Vietnam and remove at least 10 weeks of logistics costs from the supply chain.

Future proofing the Australian wool industry

Bio-security

Export of greasy wool could be closed down without warning in the event of a foot and mouth disease outbreak (or similar biosecurity event).

Without any local manufacturing, the wool industry would have no alternative markets to sell greasy wool and therefore no capacity to generate revenue to continue operations.

Geo-politics

With near 90% of all greasy wool being exported to a single market, the risk of geo-political intervention in the industry is high.

Other rural industries (beef, barley, wine, cotton, lobster and timber) have been devastated by unofficial bans and punitive tariffs for geopolitical purposes

Market access

The European Union (EU) is introducing full product traceability (including environmental sustainability and ethical treatment of animals.

This could become a technical barrier to the highest value market for Australian wool as Chinese processors are not likely to secure adequate accreditation.

We’ve been exporting greasy wool for decades, with little control or return. QWool gives growers like us – and our kids – a real stake in the supply chain again. It’s practical, smart, and long overdue.”

Sam McDonald

Wool producer and QWool investor