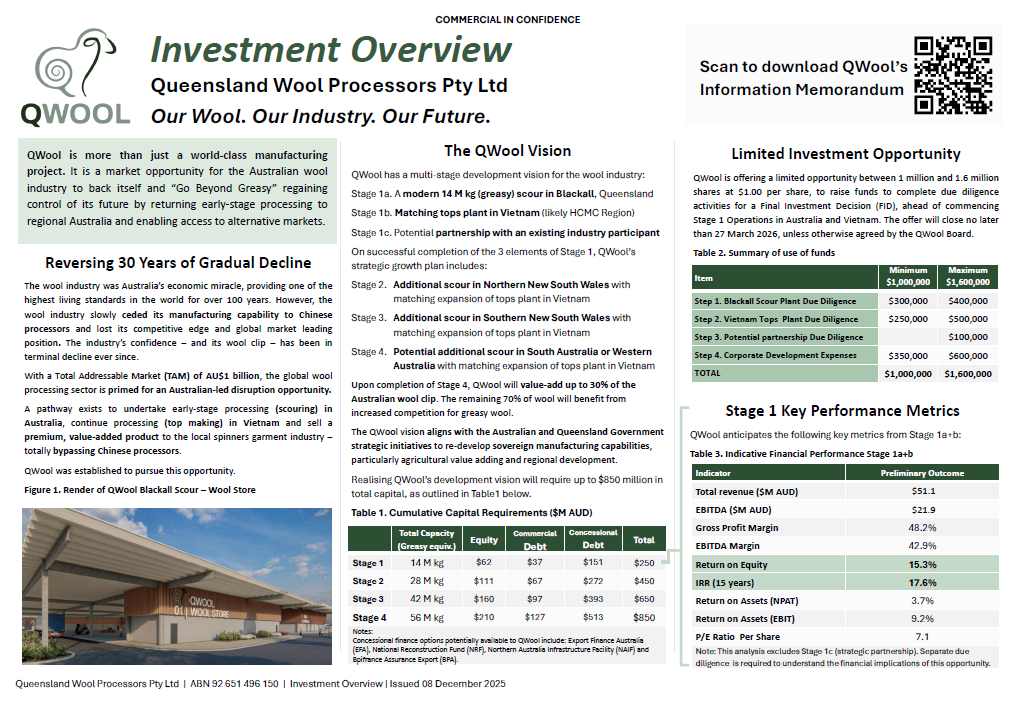

Current investment opportunity

QWool is currently seeking funds to complete its Bankable Feasibility Study for Stage 1. The funds will be spent in four (4) key areas:

- Finalisation of items required for the Final Investment Decision (FID) of Stage 1a (the Blackall wool scour)

- Bankable feasibility for Stage 1b (Vietnam top making plant), incorporating consideration of subsequent expansion in Stages 2-4.

- Detailed investigation of Stage 1c (potential partnership or investment to support industry transformation).

- Development of central support functions to enable subsequent capital raise and project delivery.

For more information, download the Project Overview and the Information Memorandum.

A robust opportunity for growth

Realising QWool’s development vision will require up to $850 million in total capital, made up of $210 million in equity and $640 million in debt (25:75 split). Debt financing is assumed from both commercial and concessional providers.

Cumulative Capital Requirements

| Stage | Total Capacity (Clean equiv.) | Equity | Commercial Debt | Concessional Debt | Total |

|---|---|---|---|---|---|

| Stage 1 | 9 M kg | $62 | $37 | $151 | $250 |

| Stage 2 | 18 M kg | $111 | $67 | $272 | $450 |

| Stage 3 | 27 M kg | $160 | $97 | $393 | $650 |

| Stage 4 | 36 M kg | $210 | $127 | $513 | $850 |

- Overview of stages are included in Page 9 (Strategic Overview – Staged Development Approach)

- Concessional finance options potentially available to QWool include:

- Export Finance Australia (EFA)

- National Reconstruction Fund (NRF)

- Northern Australia Infrastructure Facility (NAIF)

- Bpifrance Assurance Export (BPA)

Strong investor returns expected

QWool anticipates the following key financial performance metrics from Stage 1.

Indicative Financial Performance Stage 1a+b

| Indicator | Preliminary Outcome |

|---|---|

| Total revenue | $51.1 M (AUD) |

| EBITDA | $21.9 M (AUD) |

| Gross Profit Margin | 48.2% |

| EBITDA Margin | 42.9% |

| Return on Equity | 15.3% |

| Return on Assets (NPAT) | 3.7% |

| Return on Assets (EBIT) | 9.2% |

| P/E Ratio Per Share | 7.1 |

Note: This analysis excludes Stage 1c (strategic partnership). Separate due diligence is required to understand the financial implications of this opportunity.

Project status

QWool has adopted the assessment framework utilised by Infrastructure Australia to deliver the project due diligence.

Step 1

Define Problems and

opportunities

2020: “Going beyond Greasy” feasibility report by independent economic consultants identified export market opportunities beyond greasy wool and found domestic processing at scale could be potentially viable.

Step 2

Identify and analyse

options

2021-23: QWool established and commences options analysis on market access opportunities, supply and value chain pathways and process design and plant configuration.

Step 3

Develop Bankable Feasibility Study [UNDERWAY]

2025: Queensland Government provides grant to QWool to commence Bankable Feasibility Study for Stage 1a (Blackall Project).

2025: QWool undertakes capital raise to complete Bankable Feasibility Study for Stage 1b (Tops Plant in Vietnam) and due diligence for Stage 1c (industry partnership).

Step 4

Capital raise to commence

operations

2026: Pending completion of the BFS, QWool will seek a capital raise to commence construction and operations.

Investor Library

We are not waiting for the system to fix itself. We’re building a better one – from the ground up.

John Abbott

Executive Chairman